What if I get Audited by the IRS?

Audits by the Internal Revenue Service (IRS) are dreaded by taxpayers. The fear of an audit often stems from the misconception that the IRS conducts them frequently and that they are always punitive. However, the reality is that audits are rare, and they don’t always result in penalties. The IRS selects returns for audit using various methods, including random selection, information matching, and related examinations.

Between 2010 and 2018, the IRS audited only 0.6% of all individual tax returns, which is a relatively small percentage. This low rate of audit is primarily due to the IRS’s limited resources, which forces them to be selective about the returns they choose to audit. Furthermore, the IRS is only interested in audits that are likely to yield significant amounts of tax revenue, which is why they tend to focus on high-income earners and those who claim unusual deductions or credits.

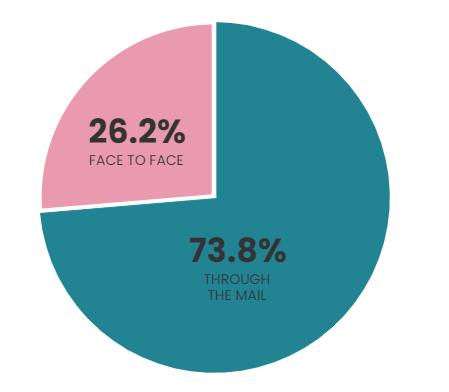

Most audits don’t involve face-to-face meetings with IRS agents or representatives. In 2019, the latest year for which data is available, 73.8% were actually conducted through the mail; only 26.2% involved face-to-face meetings.

Source: IRS.gov, 2022

One of the most common methods that the IRS uses to select returns for audit is random selection. The IRS uses a statistical formula to select returns randomly, which means that any taxpayer has a chance of being audited. However, the probability of being audited through this method is relatively low. The IRS also uses information matching to select returns for audit. In this method, the IRS compares reports from payers, such as W2 forms from employers and 1099 forms from banks and brokerages, to the returns filed by taxpayers. If the information on these forms does not match the information on the taxpayer’s return, the return may be examined further.

Related examinations are another method used by the IRS to select returns for audit. In this method, the IRS selects returns that involve issues or transactions with other taxpayers whose returns have been selected for examination. For example, if a taxpayer claims a deduction for a charitable donation, and the charity involved in the donation is also being audited, the taxpayer’s return may be selected for examination.

While an audit can be a stressful experience, there are steps that taxpayers can take to reduce the chances of being audited:

- For example, providing complete information is critical to avoid a possible audit. One of the most commonly overlooked pieces of information is missing Social Security numbers, including those for dependent children and ex-spouses. The IRS needs this information to match the taxpayer’s return to the correct Social Security records. Failure to include these numbers can result in an audit.

- Another step that taxpayers can take to reduce the chances of an audit is to avoid math errors. When the IRS receives a return that contains math errors, it assesses the error and sends a notice without following its normal deficiency procedures. Therefore, double-checking all calculations can help avoid an audit.

- Matching statements is another way to reduce the chances of an audit. The numbers on any W-2 and 1099 forms must match the returns to which they are tied. If they don’t match, the return may be flagged for an audit.

- Lastly, it’s essential to keep complete records to make it easier to comply with IRS requests for documentation. While keeping complete records may not reduce the chances of an audit, it can make the process less stressful and easier to navigate.

An audit by the IRS is a rare event, and it doesn’t necessarily imply that the taxpayer has done something wrong. The IRS selects returns for audit using various methods, including random selection, information matching, and related examinations. To reduce the chances of being audited, taxpayers can provide complete information, avoid math errors, match their statements, not repeat past mistakes, and keep complete records. It’s important to remember that the information provided in this material is not intended as tax or legal advice, and taxpayers should consult legal or tax professionals for specific information regarding their individual situation.